10-Q: Quarterly report [Sections 13 or 15(d)]

Published on May 9, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

OR

For the transition period from to

Commission File Number:

(Exact name of Registrant as specified in its Charter)

|

||

(State or other jurisdiction of |

(I.R.S. Employer |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act: None.

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

☒ |

Smaller reporting company |

|||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 9, 2025, the issuer had the following shares outstanding:

Explanatory Note

This Quarterly Report on Form 10-Q of New Mountain Net Lease Trust, a Maryland statutory trust (the “Company”), includes the financial statements and other financial information of (i) the Company and (ii) the Company’s accounting predecessor, New Mountain Net Lease Partners Corporation, a Maryland corporation (the “Predecessor”), which owned a portfolio of stabilized, net leased industrial assets comprising nearly 15 million square feet (unaudited) and a weighted average remaining lease term (“WALT”) of 15 years (the “Seed Portfolio”) that was contributed to the Company on January 2, 2025, in connection with the completion of the Formation Transactions (as defined below).

On January 2, 2025, the Company completed a recapitalization transaction, which included the following transactions (collectively, referred to as, the “Formation Transactions”):

| ● | New Mountain Finance Advisers, L.L.C., a Delaware limited liability company and affiliate of New Mountain (the “Adviser”), determined the net asset value (“NAV”) of the Seed Portfolio as of September 30, 2024 (the “Seed Portfolio Fair Value”), and our Board of Trustees engaged CBRE Capital Advisors, Inc. (“CBRE”) to provide a fairness opinion with respect to such valuation. CBRE’s fairness opinion was obtained on October 30, 2024, and delivered to our Board of Trustees. |

| ● | New Mountain Net Lease Partners, L.P., a Delaware limited partnership (“NM Fund I”), contributed 100% of the common stock of the Predecessor, which prior to such contribution indirectly owned the Seed Portfolio, to the Company in exchange for a number of the Company’s common shares based on the Seed Portfolio Fair Value, divided by $20.00 (the “REIT Contribution”). |

| ● | Substantially concurrently with the REIT Contribution, the Predecessor filed articles of conversion to convert to a Delaware limited partnership (the “OP Conversion”); |

| ● | In connection with the OP Conversion, the Predecessor changed its name to NEWLEASE Operating Partnership LP (after such conversion and name change, referred to as, the “Operating Partnership”). |

| ● | NM Fund I then distributed in kind our common shares that it received in connection with the REIT Contribution to its existing partners in proportion to their ownership in NM Fund I immediately prior to the completion of the Formation Transactions, who had the opportunity to elect to have their common shares repurchased by us. |

As used throughout this document, the terms the “Company,” “NEWLEASE,” “we,” “our,” and “us” mean:

| ● | The Predecessor for periods on or prior to the completion of the Formation Transactions on January 2, 2025; and |

| ● | The combined operations of the Company and the Predecessor beginning January 2, 2025, following the completion of the Formation Transactions. |

In addition to the financial statements contained herein, you should read and consider the audited financial statements and accompanying notes thereto of the Company for the year ended December 31, 2024 included in our Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 28, 2025.

Table of Contents

3

PART I – Financial Information

ITEM I: Financial Statements

New Mountain Net Lease Trust

CONSOLIDATED BALANCE SHEETS (unaudited)

(Dollars in thousands, except per share data)

|

March 31, 2025 |

|

December 31, 2024 |

|||

Assets |

|

|

|

|

||

Investments in real estate, net |

$ |

|

$ |

|

||

Intangible assets, net |

|

|

||||

Cash and cash equivalents |

|

|

||||

Restricted cash |

|

|

|

|

||

Other assets |

|

|

||||

Total assets |

$ |

|

$ |

|

||

Liabilities |

|

|

||||

Mortgage notes and credit facilities, net |

$ |

|

$ |

|

||

Subscriptions received in advance |

|

|

||||

Accounts payable and accrued expenses |

|

|

||||

Affiliate line of credit |

|

— |

||||

Due to affiliates |

|

|

||||

Distribution payable |

|

— |

||||

Intangible liabilities, net |

|

|

||||

Other liabilities |

|

|

||||

Total liabilities |

|

|

||||

Commitments and contingencies (see Note 13) |

|

|

||||

Equity |

|

|

||||

Common shares – Class A; $ |

|

|

|

|

||

Common shares – Class F; $ |

|

|

||||

Common shares – Class I; $ |

|

— |

||||

Common shares – Class E; $ |

|

|

||||

Additional paid-in capital |

|

|

|

|

||

Earnings less than distributions |

( |

( |

||||

Total shareholders’ equity |

|

|

||||

Non-controlling interests |

|

|

||||

Total equity |

|

|

|

|

||

Total liabilities and shareholders’ equity |

$ |

|

$ |

|

||

The accompanying notes are an integral part of the consolidated financial statements.

4

New Mountain Net Lease Trust

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(Dollars in thousands, except per share data)

|

Three months ended |

|||||

|

March 31, 2025 |

|

March 31, 2024 |

|||

Revenues |

|

|

|

|

||

Rental revenue |

$ |

|

$ |

|

||

Total revenues |

|

|

|

|

||

Expenses |

|

|

||||

Property operating expense |

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

||

Management fee |

|

— |

||||

Performance participation allocation |

|

— |

||||

General and administrative |

|

|

|

|

||

Organizational costs |

|

— |

||||

Total expenses |

|

|

|

|

||

Other (expense) / income |

|

|

||||

Interest expense |

|

( |

|

( |

||

Other income |

|

|

|

|

||

Net change in unrealized (depreciation)/appreciation on investments related to foreign exchange fluctuations |

|

( |

|

|

||

Net change in unrealized appreciation on derivative swaps |

|

— |

|

|

||

Net realized loss on financial instruments |

|

— |

|

( |

||

Total other (expense) / income |

|

( |

|

( |

||

Net income before income tax expense |

|

|

|

|

||

Income tax benefit (expense) |

|

|

|

( |

||

Net income |

|

|

|

|

||

Net income attributable to non-controlling interests |

|

( |

|

( |

||

Net income attributable to the Company’s shareholder |

$ |

|

$ |

|

||

Class A weighted average shares outstanding – basic and diluted |

|

|

||||

Class F weighted average shares outstanding – basic and diluted |

|

|

||||

Class I weighted average shares outstanding – basic and diluted |

|

— |

||||

Class E weighted average shares outstanding – basic |

|

|

|

|

||

Class E weighted average shares outstanding – diluted |

|

|

||||

Earnings per Class A share - basic and diluted |

$ |

|

$ |

|

||

Earnings per Class F share - basic and diluted |

$ |

|

$ |

|

||

Earnings per Class I share - basic and diluted |

$ |

|

$ |

— |

||

Earnings per Class E share - basic and diluted |

$ |

|

$ |

|

||

The accompanying notes are an integral part of the consolidated financial statements.

5

New Mountain Net Lease Trust

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (unaudited)

(Dollars in thousands, except per share data)

Additional |

|

Earnings |

|

Total |

|

||||||||||||||||||||||

Par Value |

Paid |

less than |

Shareholders’ |

Non-controlling |

|||||||||||||||||||||||

|

Class A |

|

Class F |

|

Class I |

|

Class E |

|

in Capital |

|

distributions |

|

Equity |

|

Interests |

|

Total Equity |

||||||||||

Balance at December 31, 2024 |

$ |

|

$ |

|

$ |

— |

$ |

|

$ |

|

$ |

( |

$ |

|

$ |

|

$ |

|

|||||||||

Common shares issued |

|

|

|

|

— |

|

— |

|

— |

|

|||||||||||||||||

Offering costs |

|

— |

— |

— |

— |

( |

— |

( |

— |

( |

|||||||||||||||||

Common shares redeemed |

|

— |

— |

— |

( |

( |

— |

( |

— |

( |

|||||||||||||||||

Net income |

|

— |

— |

— |

— |

— |

|

|

|

|

|||||||||||||||||

Distributions on common shares ($ |

— |

— |

— |

— |

— |

( |

( |

— |

( |

||||||||||||||||||

Distributions to non-controlling interests |

|

— |

— |

— |

— |

— |

— |

— |

( |

( |

|||||||||||||||||

Balance at March 31, 2025 |

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

( |

$ |

|

$ |

|

$ |

|

|||||||||

|

|

|

|

|

Additional |

|

Earnings |

|

Total |

|

|

||||||||||||||||

Par Value |

Paid |

less than |

Shareholders’ |

Non-controlling |

|||||||||||||||||||||||

|

Class A |

|

Class F |

|

Class I |

|

Class E |

|

in Capital |

|

distributions |

|

Equity |

|

Interests |

|

Total Equity |

||||||||||

Balance at December 31, 2023 |

$ |

|

$ |

$ |

— |

$ |

$ |

|

$ |

( |

$ |

|

$ |

|

$ |

|

|||||||||||

Common shares issued |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|||||||||

Offering costs |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|||||||||

Common shares redeemed |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|||||||||

Net income |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|||||||||

Distributions on common shares ($ |

|

— |

|

— |

|

— |

|

— |

|

— |

|

( |

|

( |

|

— |

|

( |

|||||||||

Distributions to non-controlling interests |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

( |

|

( |

|||||||||

Balance at March 31, 2024 |

$ |

|

$ |

|

$ |

— |

$ |

|

$ |

|

$ |

( |

$ |

|

$ |

|

$ |

|

|||||||||

The accompanying notes are an integral part of the consolidated financial statements.

6

New Mountain Net Lease Trust

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

(Dollars in thousands, except per share data)

|

Three months ended |

|||||

March 31, 2025 |

|

March 31, 2024 |

||||

Cash flows from operating activities: |

|

|

||||

Net income |

$ |

|

$ |

|

||

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

||||

Depreciation and amortization |

|

|

|

|

||

Straight-line rent adjustment |

|

( |

|

( |

||

Amortization of above / (below) market lease intangibles |

|

( |

|

( |

||

Amortization of deferred financing costs |

|

|

|

|

||

Changes in assets and liabilities |

||||||

(Increase) decrease in other assets |

|

( |

|

|

||

Increase in due to affiliates |

|

|

|

|

||

Increase (decrease) in accounts payable and accrued expenses |

|

|

|

|

||

Decrease in other liabilities |

|

( |

|

( |

||

Net cash provided by operating activities |

$ |

|

$ |

|

||

Cash flows from investing activities: |

||||||

Proceeds from partial sale of real estate |

$ |

|

$ |

|

||

Net cash provided by investing activities |

$ |

|

$ |

|

||

Cash flows from financing activities: |

||||||

Proceeds from issuance of common shares |

$ |

$ |

— |

|||

Redemptions of common stock |

|

( |

|

— |

||

Subscriptions received in advance |

|

|

|

— |

||

Payment of distributions to common shares |

|

( |

|

( |

||

Payment of distributions to non-controlling interests |

|

( |

|

( |

||

Borrowings under affiliated line of credit |

|

|

|

— |

||

Borrowings under revolving credit facility |

|

|

|

|

||

Repayment of revolving credit facility |

( |

|

( |

|||

Repayment of mortgage notes |

|

( |

( |

|||

Deferred financing costs |

( |

|

— |

|||

Net cash used in financing activities |

$ |

( |

$ |

( |

||

Net change in cash and cash equivalents and restricted cash |

$ |

( |

$ |

|

||

Cash and cash equivalents and restricted cash, beginning of year |

|

|

||||

Effects of currency translation on cash and cash equivalents, and restricted cash |

|

( |

|

( |

||

Cash and cash equivalents and restricted cash, end of year |

$ |

|

$ |

|

||

Reconciliation of cash and cash equivalents and restricted cash to the consolidated balance sheets |

||||||

Cash and cash equivalents |

$ |

|

$ |

|

||

Restricted cash |

|

|

|

|

||

Total cash and cash equivalents and restricted cash |

$ |

|

$ |

|

||

Supplemental disclosures: |

|

|

||||

Interest paid |

$ |

|

$ |

|

||

Non-cash financing activities: |

||||||

Accrued distributions |

$ |

|

$ |

— |

||

Offering costs due to affiliate |

$ |

|

$ |

— |

||

Other offering costs payable |

$ |

|

$ |

— |

||

The accompanying notes are an integral part of the consolidated financial statements.

7

New Mountain Net Lease Trust

Notes to Consolidated Financial Statements (unaudited)

(Dollars in thousands, except per share data)

Note 1. Business and Organization

New Mountain Net Lease Trust (“we,” “our,” “us,” the “Company” or “NEWLEASE”) is a Maryland statutory trust formed in August 2024 to acquire, own, finance and lease a diversified portfolio of operationally critical, single-tenant, commercial net lease real estate assets primarily located in the United States. The Company is externally managed by our investment adviser, New Mountain Finance Advisers, L.L.C. (the “Adviser”), a Delaware limited liability company and an affiliate of our sponsor, New Mountain Capital, L.L.C. (the “Sponsor”).

We are structured as a non-listed, perpetual-life real estate investment trust (“REIT”), and therefore our securities are not listed on a national securities exchange and, as of the date of this report, there is no plan to list our securities on a national securities exchange. As a perpetual-life REIT, our common shares are intended to be sold monthly on a continuous basis at a price generally equal to our prior month’s net asset value (“NAV”) per share. We have elected and intend to qualify to be taxed as a REIT under the U.S. Internal Revenue Code of 1986, as amended (the “Code”), for U.S. federal income tax purposes and generally will not be subject to U.S. federal income taxes on our taxable income to the extent we annually distribute all of our REIT taxable income to shareholders and maintain our qualification as a REIT.

Our structure as a perpetual-life REIT allows us to originate, acquire, finance and manage our investment portfolio in an active and flexible manner. We believe the structure is advantageous to shareholders, as we are not limited by a pre-determined operational period and the need to liquidate assets, potentially in an unfavorable market, to satisfy a liquidity event at the end of a pre-specified period.

The Company is conducting a continuous, blind pool private offering of its common shares in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), to investors that are accredited investors (as defined in Regulation D under the Securities Act). The initial closing of our private offering occurred on January 2, 2025. The Company is authorized to issue

On January 2, 2025, NEWLEASE completed a recapitalization transaction, which included the following transactions (collectively, referred to as, the “Formation Transactions”):

| ● | The Adviser determined the net asset value (“NAV”) of the New Mountain Net Lease Partners Corporation, a Maryland Corporation (the “Predecessor”), as of September 30, 2024 (the “Seed Portfolio Fair Value”), and our Board of Trustees engaged CBRE Capital Advisors, Inc. (“CBRE”) to provide a fairness opinion with respect to such valuation. CBRE’s fairness opinion was obtained on October 30, 2024, and delivered to our Board of Trustees. |

| ● |

New Mountain Net Lease Partners, L.P., a Delaware limited partnership (“NM Fund I”), contributed |

| ● | Substantially concurrently with the REIT Contribution, the Predecessor filed articles of conversion to convert to a Delaware limited partnership (the “OP Conversion”); |

| ● | In connection with the OP Conversion, the Predecessor changed its name to NEWLEASE Operating Partnership LP (after such conversion and name change, referred to as, the “Operating Partnership”). |

8

| ● |

NM Fund I then distributed in kind the |

As used throughout this document, the terms the “Company,” “we,” “our,” and “us” mean:

| ● | The Predecessor for periods on or prior to the closing of the Formation Transactions on January 2, 2025; and |

| ● | The combined operations of the Company and the Predecessor beginning January 2, 2025, following the completion of the Formation Transactions. |

As of March 31, 2025, the Company owned

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with GAAP for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X.

In connection with the Formation Transactions, NM Fund I contributed

All intercompany balances and transactions have been eliminated in consolidation. The accompanying statements of operations for the three months ended March 31, 2025 include our consolidated accounts.

All intercompany balances and transactions have been eliminated in consolidation. The accompanying statements of operations for the three months ended March 31, 2025 include our consolidated accounts. The accompanying financial statements for the three months ended March 31, 2024 include the consolidated accounts of the Predecessor. Therefore, our results of operations, cash flows and financial condition set forth in this report are not necessarily indicative of our future results of operations, cash flows or financial condition as an independent company.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, its subsidiaries and any single member limited liability companies or other entities which are consolidated in accordance with GAAP. The Company consolidates variable interest entities (“VIEs”) when it is the primary beneficiary and voting interest entities that are generally majority owned or otherwise controlled by the Company. Generally, a VIE is an entity with one or more of the following characteristics: (1) the total equity investment at risk is not sufficient to permit the entity to finance its activities without additional subordinated financial support, (2) as a group, the holders of the equity investment at risk (a) lack the power through voting or similar rights to make decisions about the entity’s activities that significantly impact the entity’s performance, (b) have no obligation to absorb the expected losses of the entity, or (c) have no right to receive the expected residual returns of the entity, or (3) the equity investors have voting rights that are not proportional to their economic interests, and substantially all of the entity’s activities either involve, or are conducted on behalf of, an investor that has disproportionately fewer voting rights. A VIE is required to be consolidated by its primary beneficiary. The primary beneficiary of a VIE has (1) the power to direct the activities that most significantly impact the entity’s economic performance, and (2) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could be significant to the VIE.

The Company has consolidated all VIEs for the periods presented because we are the primary beneficiary and have the power to direct the activities that impact the entity’s economic performance and the obligation to absorb losses or receive benefits from the VIE.

9

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s most significant assumptions and estimates relate to the useful lives of real estate assets, lease accounting, real estate impairment assessments and allocation of fair value of purchase consideration. These estimates are based on historical experience and other assumptions which management believes are reasonable. The Company evaluates its estimates on an ongoing basis and revises these estimates and related disclosures as experience develops or new information becomes known. Actual results could differ from those estimates.

Investment in Real Estate

Real estate assets are stated at cost, less accumulated depreciation and amortization. The Company evaluates each acquisition transaction to determine whether the acquired asset meets the definition of a business and therefore accounted for as a business combination or if the acquisition transaction should be accounted for as an asset acquisition. Under Accounting Standards Update (“ASU”) 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business” (“ASU 2017-01”), an acquisition does not qualify as a business when substantially all of the fair value is concentrated in a single identifiable asset or group of similar identifiable assets or the acquisition does not include a substantive process in the form of an acquired workforce or an acquired contract that cannot be replaced without significant cost, effort or delay. Transaction costs related to acquisitions that qualify as asset acquisitions are capitalized as part of the cost basis of the acquired assets, while transaction costs for acquisitions that are deemed to be acquisitions of a business are expensed as incurred.

The Company allocates the purchase price of acquired properties accounted for as asset acquisitions to tangible and identifiable intangible assets or liabilities based on their relative fair values. Tangible assets may include land, buildings, site improvements and tenant improvements. Intangible assets include the value of in-place leases and above-market leases, and intangible liabilities include below-market leases. The fair value of the tangible assets of an acquired property with an in-place operating lease is determined by valuing the property as if it were vacant, and the “as-if-vacant” value is then allocated to the tangible assets based on the relative fair value of the tangible assets. The fair value of in-place leases is determined by considering estimates of carrying costs during the expected lease-up periods, current market conditions as well as costs to execute similar leases based on the specific characteristics of each tenant’s lease. The Company estimates the cost to execute leases with terms similar to the remaining lease terms of the in-place leases, including tenant improvements, leasing commissions, legal and other related expenses.

The values of acquired above-market and below-market leases are recorded based on the present values (using discount rates which reflect the risks associated with the leases acquired) of the differences between the contractual amounts to be received and management’s estimate of market lease rates, measured over the terms of the respective leases that management deemed appropriate at the time of the acquisitions. Such valuations include consideration of the noncancelable terms of the respective leases as well as any applicable renewal periods whereby the Company is reasonably certain the tenant will utilize their extension option. The fair values associated with below-market rental renewal options are determined based on the Company’s experience and the relevant facts and circumstances that existed at the time of the acquisitions. The values of the above-market and below-market leases are amortized over the term of the respective leases, including certain renewal options (as applicable), as an adjustment to rental revenue on the Company’s consolidated statements of operations. The value of other intangible assets (including leasing commissions, tenant improvements, etc.) is amortized to expense over the applicable terms of the respective leases. Tenant improvements are amortized on a straight-line basis over the lives of the related leases, which approximate the useful lives of the tenant improvements. If a lease were to be terminated prior to its stated expiration or not renewed, all unamortized amounts relating to that lease would be recognized in operations at that time. In making estimates of fair values for purposes of allocating purchase price, the Company utilizes a number of sources and also considers information and other factors including market conditions, the industry that the tenant operates in, characteristics of the real estate; e.g., location, size, demographics, value and comparative rental rates; tenant credit profile and the importance of the location of the real estate to the operations of the tenant’s business. Additionally, the Company considers information obtained about each property as a result of its pre-acquisition due diligence, marketing and leasing activities in estimating the relative fair value of the tangible and intangible assets and liabilities acquired. The Company’s methodology for measuring and allocating the fair value of real estate acquisitions includes both observable market data (categorized as level 2 on the three-level valuation hierarchy of Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurement), and unobservable inputs that reflect the Company’s own internal assumptions (categorized as level 3 under ASC Topic 820). Given the significance of the unobservable inputs the Company believes the allocations of fair value of real estate acquisitions should be categorized as level 3 under ASC Topic 820.

10

Management reviews each real estate investment for impairment whenever events or circumstances indicate that the carrying value of a real estate investment may not be recoverable. The review of recoverability of real estate investments held for use is based on an estimate of the undiscounted future cash flows that are expected to result from the real estate investment’s use and eventual disposition. These cash flows consider factors such as expected future operating income, trends and prospects, as well as the effects of leasing demand, capital expenditures, competition and other factors. If an impairment event exists due to the projected inability to recover the carrying value of a real estate investment, an impairment loss is recorded to the extent that the carrying value exceeds estimated fair value.

Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the assets. The Company considers the period of future benefit of each respective asset to determine its appropriate useful life. The estimated useful lives of the Company’s real estate assets by class are generally as follows:

Depreciation or |

||||

Amortization Range |

||||

Building and Intangibles |

|

Depreciation or Amortization Basis |

|

(in years) |

Building |

|

Useful life of building |

|

|

Building improvements |

|

Useful life of improvements |

|

|

Tenant improvement allowance |

|

Shorter of useful life or life of lease |

|

|

Lease costs |

|

Life of lease |

|

|

Legal and marketing costs |

|

Life of lease |

|

|

Above or below market lease value |

|

Life of lease |

|

|

Lease in place value |

|

Life of lease |

|

Expenditures for improvements that substantially extend the useful lives of the assets are capitalized. Expenditures for maintenance, repairs and betterments that do not substantially prolong the normal useful life of an asset are charged to operations as incurred.

Sale-Leasebacks

All sale-leaseback transactions are evaluated in accordance with GAAP to determine if they meet the criteria for sale recognition.

The Company concluded that all sale-leaseback transactions qualified as sales under the applicable accounting standards, with control of the assets being effectively transferred to the buyers. The Company did not complete any sale-leaseback transactions for the three months ended March 31, 2025 and March 31, 2024.

Real Estate Held for Sale and Discontinued Operations

The Company follows the guidance for reporting discontinued operations, whereby a disposal of an individual property or group of properties is required to be reported in “discontinued operations” only if the disposal represents a strategic shift that has, or will have, a major effect on the Company’s operations and financial results. The results of operations for those properties not meeting such criteria are reported in “continuing operations” in the consolidated statements of operations. There were no discontinued operations in the current year.

The carrying values of the assets and liabilities of properties determined to be held for sale, principally the net book values of the real estate are reclassified as “held for sale” on the Company’s consolidated balance sheets at the time such determinations are made, on a prospective basis only.

The Company classifies the assets and liabilities related to its real estate investments as held for sale in the period in which all of the following conditions are met: (i) the Company commits to a plan and has the authority to sell the asset; (ii) the asset is available for sale in its current condition; (iii) the Company has initiated an active marketing plan to locate a buyer for the asset; (iv) the sale of the asset is both probable and expected to qualify for full sales recognition within a period of 12 months; (v) the asset is being actively marketed for sale at a price that is reasonable in relation to its current fair value; and (vi) the Company does not anticipate changes to its plan to sell the asset or that the plan will be withdrawn. The Company classifies held for sale assets and liabilities at the lower of depreciated cost or fair value less closing costs. There were

11

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Cash and cash equivalents are maintained at financial institutions and, at times, balances may exceed the limits insured by the Federal Deposit Insurance Corporation, however, the Company deposits its cash and cash equivalents with high credit-quality institutions to minimize credit risk exposure.

Restricted Cash

As of March 31, 2025 and December 31, 2024, the restricted cash balance of $

Subscriptions Received in Advance

Subscriptions received in advance represent amounts received from investors prior to the April 1, 2025 effective date of their investment in the Company. These amounts are recorded as a liability until the subscription is fully processed and the investor’s capital is accepted by the Company. Upon acceptance, the liability is reclassified to equity.

Derivatives

The Company may enter into derivative financial instruments, such as interest rate swaps and caps, to manage interest rate exposure. The Company’s derivative instruments may include instruments that do not qualify for cash flow hedge accounting treatment. To qualify for hedge accounting, the hedging relationship, both at inception of the hedge and on an ongoing basis, must be expected to be highly effective at offsetting the variability in hedged cash flows attributable to the hedged risk (e.g., a variable interest rate index).

All derivatives are recognized on the consolidated balance sheets at fair value and are generally reported gross, regardless of netting arrangements. Derivatives not designated as accounting hedges are not speculative and are used to manage the Company’s exposure to interest rate movements and other identified risks but do not meet the hedge accounting requirements or the Company has not elected to apply hedge accounting.

The fair value of the interest rate swaps and caps contracts are estimated at an amount the Company would receive or pay to terminate the agreement at the balance sheet date, taking into consideration current interest rates, foreign exchange rates, and creditworthiness of the counterparty.

Fair Value Measurements

The accounting guidance for fair value measurement establishes a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three levels:

• |

Level 1 – Inputs to the valuation methodology are quoted prices (unadjusted) for identical, unrestricted assets or liabilities in active markets. |

• |

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly, valued using inputs other than quoted prices. |

• |

Level 3 – Prices or valuation that requires inputs that are both significant to the fair value measurement and unobservable. |

Fair value is a market-based measurement, based on assumptions of prices and inputs considered from the perspective of a market participant as of the measurement date, rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Company’s own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement date. The inputs used to measure fair value may fall into different levels. In all instances when the inputs fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level of input that is significant to the fair value measurement in its entirety. As such, a Level 3 fair value measurement may include inputs that are both observable and unobservable. Gains and losses for such assets categorized within Level 3 may include changes in fair value that are attributable to both observable inputs and unobservable inputs.

12

Revenue Recognition and Accounts Receivable

Pursuant to ASC 842, the Company does not separate the non-lease components, such as common area maintenance, from its leases. Management has determined that all of the Company’s leases with its various tenants are operating leases. The Company recognizes minimum rent, including rental abatements, lease incentives and contractual fixed increases attributable to operating leases on a straight-line basis over the term of the related leases when collectability is probable and records amounts expected to be received in later years as straight-line rent receivable. Straight-line rent receivable was $

Accounts receivables include unpaid amounts billed to tenants, disputed enforceable charges and accrued revenues for future billings to tenants for property expenses. We evaluate the collectability of amounts due from tenants and disputed enforceable charges on both a lease-by-lease and a portfolio-level, which result from the inability of tenants to make required payments under their operating lease agreements. We recognize changes in the collectability assessment of these operating leases as adjustments to rental revenue in accordance with ASC 842 Leases. Management exercises judgment in assessing collectability and considers payment history, current credit status and publicly available information about the financial condition of the tenant, among other factors. Accounts receivables, and straight-line rents receivable, are written-off directly when management deems the collectability of substantially all future lease payments from a specific lease is not probable, at which point, the Company will begin recognizing revenue from such leases prospectively, based on actual amounts received. This write-off effectively reduces cumulative non-cash rental income recognized from the straight lining of rents since lease commencement. If the Company subsequently determines that it is probable it will collect substantially all of the lessee’s remaining lease payments under the lease term, the Company will reinstate the receivables balance, including those arising from the straight lining of rents.

Deferred Financing Costs

Financing costs related to the issuance of the Company’s long-term debt are deferred and amortized as an increase to interest expense over the term of the related debt instrument using the straight-line method, which approximates the effective interest method. The carrying value of the deferred financing costs related to mortgage notes and credit facilities was $

Earnings Per Share

The Company’s earnings per share (“EPS”) amounts have been computed based on the weighted-average number of shares of common stock outstanding for the period. The Company uses the two-class method in calculating EPS when it issues securities other than common stock that contractually entitle the holder to participate in dividends and earnings of the Company when, and if, the Company declares dividends on its common stock. Basic EPS is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period of computation. Diluted EPS is computed by dividing net income (loss) by the weighted average number of shares of common stock assuming all potential shares had been issued, and its related net impact to net assets accounted for, and the additional shares of common stock were dilutive. Diluted EPS reflects the potential dilution, using the as-if-converted method for convertible debt, which could occur if all potentially dilutive securities were exercised. Dilutive securities include unvested restricted stock units (“RSUs”), and other share-based payment awards. RSUs are included in the calculation of diluted EPS under the treasury stock method when the effect is dilutive, based on the number of shares that would be issued if the end-of-period conditions were met, including the assumed satisfaction of any performance or service conditions. All classes of common stock are allocated net income/(loss) at the same rate per share, excluding management fees and performance participation allocation, and receive the same gross distribution per share. For comparability purposes for periods prior to the closing of the Formation Transaction on January 2, 2025, the Predecessor’s shares are adjusted to reflect the retrospective impact of the formation transaction for the

13

The basic and diluted EPS for the three months ended March 31, 2025 and March 31, 2024 are as follows:

|

March 31, 2025 |

|

March 31, 2024 |

|||||||||

|

Basic EPS |

|

Diluted EPS |

|

Basic EPS |

|

Diluted EPS |

|||||

Class A |

$ |

|

$ |

|

$ |

|

$ |

|

||||

Class F |

$ |

|

$ |

|

$ |

|

$ |

|

||||

Class I |

$ |

|

$ |

|

$ |

|

$ |

|

||||

Class E |

$ |

|

$ |

|

$ |

|

$ |

|

||||

Segment Information

The Company leases its net-lease properties primarily to non-investment grade industrial tenants and reports its business as a reportable segment. The Company’s Chief Executive Officer is the Chief Operating Decision Maker (“CODM”) who allocates resources and assesses financial performance. The CODM reviews net income and assesses the performance of the Company’s current portfolio of net-lease properties and makes operating decisions accordingly. Net income is used by the CODM in assessing the operating performance of the segment and to monitor budget versus actual results. The measure of segment assets is reported on the Consolidated Balance Sheets as total assets. As a result, the Company conducts its business as a single operating segment. Given, the triple-net nature of the leases, all expenses categories presented on the statement of operations are significant.

Income Taxes

The Company has elected and is qualified to be taxed as a REIT, as it complies with the related provisions under the Internal Revenue Code of 1986, as amended. Accordingly, the Company generally is not and will not be subject to U.S. federal income tax to the extent of its distributions to shareholders and as long as certain asset, income and share ownership tests are met. To qualify as a REIT, the Company must annually distribute at least 90% of its REIT taxable income to its shareholders and meet certain other requirements. Under certain circumstances, federal income and excise taxes may be due on its undistributed taxable income. The Company may also be subject to certain state, local and franchise taxes. If the Company fails to meet these requirements, it will be subject to U.S. federal income tax, which could have a material adverse impact on its results of operations and amounts available for distributions to its shareholders. Application of tax laws and regulations to various types of transactions is susceptible to varying interpretations. Therefore, amounts reported in the financial statements could be changed at a later date upon final determination by the taxing authorities. No such examinations by taxing authorities are presently in process.

The Company provides for uncertain tax positions based upon management’s assessment of whether a tax benefit is more likely than not to be sustained upon examination by tax authorities. Management is required to determine whether a tax position is more likely than not to be sustained upon examination by tax authorities, including resolution of any related appeals or litigation processes, based on the technical merits of the position. Because assumptions are used in determining whether a tax benefit is more likely than not to be sustained upon examination by tax authorities, actual results may differ from the Company’s estimates under different assumptions or conditions.

The Company recognizes uncertain tax positions and tax-related interest and penalties, if applicable, as a component of income tax expense. For the three months ended March 31, 2025 and March 31, 2024,

Foreign Exchange

The accounting records of the Company are maintained in U.S. dollars. Investments denominated in foreign currencies are translated into U.S. dollars based on the rate of exchange of such currencies on the date of valuation. Purchases and sales of investments and income and expense items denominated in foreign currencies are translated into U.S. dollars based on the rate of exchange of such currencies on the respective dates of the transactions. Such fluctuations are included with “Net change in unrealized appreciation/(depreciation) on investments related to foreign exchange fluctuations” and “Net realized loss on financial instruments” in the Consolidated Statements of Operations.

14

Issued and Adopted Accounting Pronouncements

In August 2023, the Financial Accounting Standards Board (“FASB”) issued ASU 2023-05, “Business Combinations - Joint Venture Formations (Subtopic 805-60): Recognition and Initial Measurement” (“ASU 2023-05”). ASU 2023-05 addresses the accounting for contributions made to a joint venture, upon formation, in a joint venture’s separate financial statements. Prior to the amendment, the FASB did not provide specific authoritative guidance on the initial measurement of assets and liabilities assumed by a joint venture upon its formation. ASU 2023-05 requires a joint venture to recognize and initially measure its assets and liabilities at fair value (with exceptions to fair value measurement that are consistent with the business combinations guidance). ASU 2023-05 was adopted January 1, 2025, and did not have a material impact on the Company’s consolidated financial statements.

In December 2023, FASB issued ASU 2023-09 Income Tax (Topic 740): Improvements to Income Tax Disclosures which provides for additional disclosures for rate reconciliations, disaggregation of income taxes paid, and other disclosures. The amendments in this ASU are effective for public business entities for fiscal years beginning after December 15, 2024. The adoption of ASU 2023-09 did not have a material impact on the Company’s consolidated financial statements.

Recently Issued and Accounting Pronouncements Not Adopted

In November 2024, the FASB issued ASU2024-03 Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosure (Subtopic 220-40): Disaggregation of Income Statement Expenses which provides an update to improve the disclosures about a public business entity’s expenses and provide more detailed information about the types of expenses, including purchase of inventory, employee compensation, depreciation and amortization in commonly presented expense captions such as cost of sales, selling, general and administrative expenses and research and development. ASU 2024-03 is effective on either a prospective basis, with the option for retrospective application, for annual periods beginning after December 15, 2026, for interim periods within fiscal years beginning after December 15, 2027, and early adoption is permitted. The Company did not early adopt ASU 2024-03 and is still evaluating the impact on its consolidated financial statements.

Note 3. Investments in Real Estate, Net

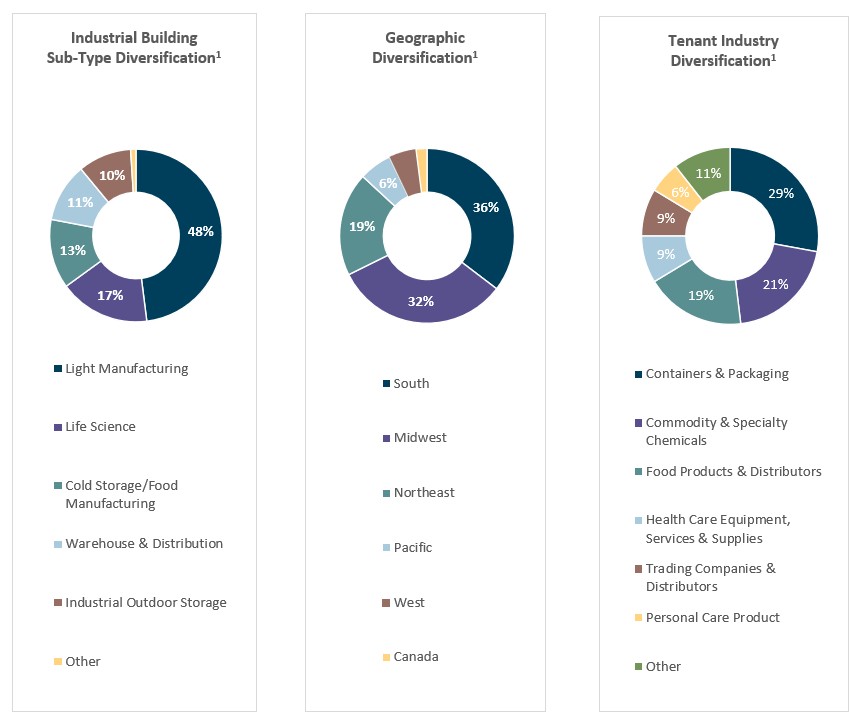

The Company owns and manages primarily single-tenant, non-investment-grade net-leased industrial real estate properties. As of March 31, 2025, the Company owned

Real estate activity, is composed of the following:

|

March 31, |

December 31, |

||||

|

2025 |

|

2024 |

|||

Buildings and improvements |

$ |

|

$ |

|

||

Land and land improvements |

|

|

|

|

||

Total |

|

|

|

|

||

Accumulated depreciation |

|

( |

|

( |

||

Investments in real estate, net |

$ |

|

$ |

|

||

Acquisitions

The Company did

Dispositions

The Company did

15

Note 4. Intangible Assets and Liabilities

Intangible assets and liabilities consisted of the following:

|

March 31, 2025 |

||||||||||

Weighted average |

|||||||||||

|

Gross carrying |

|

Accumulated |

|

Net carrying |

|

amortization |

||||

|

amount |

|

amortization |

|

amount |

|

period (years) |

||||

Intangible assets |

|

|

|

|

|

|

|

|

|||

In-place lease intangibles |

$ |

|

$ |

( |

$ |

|

|

||||

Above-market lease |

|

|

|

( |

|

|

|

||||

Other lease intangibles |

|

|

|

( |

|

|

|

||||

Total intangible assets |

$ |

|

$ |

( |

$ |

|

|

||||

|

|||||||||||

Intangible liabilities |

|

|

|

|

|

||||||

Below-market leases |

$ |

|

$ |

( |

$ |

|

|

||||

Total intangible liabilities |

$ |

|

$ |

( |

$ |

|

|

||||

|

December 31, 2024 |

||||||||||

|

Weighted average |

||||||||||

|

Gross carrying |

|

Accumulated |

|

Net carrying |

|

amortization |

||||

|

amount |

|

amortization |

|

amount |

|

period (years) |

||||

Intangible assets |

|

|

|

|

|

|

|

|

|||

In-place lease intangibles |

$ |

|

$ |

( |

$ |

|

|

||||

Above-market lease |

|

|

|

( |

|

|

|

||||

Other lease intangibles |

|

|

|

( |

|

|

|

||||

Total intangible assets |

$ |

|

$ |

( |

$ |

|

|

||||

Intangible liabilities |

|

|

|

|

|||||||

Below-market leases |

$ |

|

$ |

( |

$ |

|

|

||||

Total intangible liabilities |

$ |

|

$ |

( |

$ |

|

|

||||

The Company records amortization of in-place lease assets to amortization expense and records net amortization of above-market and below-market lease intangibles to rental revenue. Amortization expense for the three months ended March 31, 2025 and March 31, 2024 was $

The estimated future amortization of in-place lease assets and other lease intangibles are as follows:

|

In-place |

|

Above-market |

|

Other lease |

|

Below-market |

|||||

|

lease assets |

|

lease asset |

|

intangible assets |

|

lease liabilities |

|||||

2025 (Remaining) |

$ |

|

$ |

|

$ |

|

$ |

|

||||

2026 |

|

|

|

|

|

|

|

|

||||

2027 |

|

|

|

|

|

|

|

|

||||

2028 |

|

|

|

|

|

|

|

|

||||

2029 |

|

|

|

|

|

|

|

|

||||

Thereafter |

|

|

|

|

|

|

|

|

||||

Total |

$ |

|

$ |

|

$ |

|

$ |

|

||||

16

Note 5. Variable Interest Entities

The Company owns equity interests through joint ventures that are considered variable interest entities (“VIE”). We are the primary beneficiary of the VIEs and consolidate them as we have the power to direct the activities that most significantly impact the entity’s economic performance. The assets of the consolidated VIEs may only be used to settle the obligations of the entities and such obligations are secured only by the assets of the entities and are non-recourse to us. The following table summarizes the assets and liabilities of consolidated VIEs. Based on consolidation guidance, the Company has concluded that the equity interest through a joint venture as VIEs as the minority interest holder in the joint venture do not possess kick-out rights or substantive participating rights. Accordingly, the Company consolidates its equity interest in the joint venture. The portions of a consolidated entity not owned by the Company are presented as non-controlling interests as of and during the periods presented.

|

March 31, 2025 |

|

December 31, 2024 |

|||

Assets |

|

|

|

|

||

Investments in real estate, net |

$ |

|

$ |

|

||

Intangible assets, net |

|

|

|

|

||

Cash and cash equivalents |

|

|

|

|

||

Other assets |

|

|

|

|

||

Total assets |

$ |

|

$ |

|

||

Liabilities |

|

|

||||

Mortgages payable, net |

$ |

|

$ |

|

||

Accounts payable and accrued expenses |

|

|

|

|

||

Intangible liabilities, net |

|

|

|

|

||

Due to affiliates |

|

|

|

|

||

Other liabilities |

|

|

|

|

||

Total liabilities |

$ |

|

$ |

|

||

Note 6. Fair Value Measurements

The Company measures certain financial assets and liabilities at fair value on a recurring basis in accordance with ASC 820 - Fair Value Measurement. This includes the use of quoted prices in active markets, observable inputs, and unobservable inputs to determine the fair value of financial assets and liabilities. The accounting guidance for fair value measurement establishes a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three levels:

| ● | Level 1 – Inputs to the valuation methodology are quoted prices (unadjusted) for identical, unrestricted assets or liabilities in active markets. |

| ● | Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly, valued using inputs other than quoted prices. |

| ● | Level 3 – Prices or valuation that requires inputs that are both significant to the fair value measurement and unobservable. |

The fair value of the Company’s financial instruments and non-financial assets has been estimated using available market information and accepted valuation methods. Given the inherent judgment and subjectivity involved, these estimates may differ from the values that could be realized in a sale or transaction.

Financial Assets and Liabilities Measured at Fair Value

The Company had

Financial Assets and Liabilities Measured at Fair Value on a Non-Recurring Basis

The Company had

17

Financial Assets and Liabilities not Measured at Fair Value

The carrying amounts of cash and cash equivalents, restricted cash, receivables, certain other assets, accounts payable, accrued expenses and other liabilities approximate their fair value due to their terms and/or short-term nature. Financial liabilities not measured at fair value on our consolidated balance sheets consist of notes and mortgages payable and the revolving credit facility. The following table summarizes the carrying amounts and fair value of these financial instruments as of the dates set forth below.

As of March 31, 2025 |

As of December 31, 2024 |

|||||||||||

|

Carrying Amount |

|

Fair Value |

|

Carrying Amount |

|

Fair Value |

|||||

Mortgages payable, net |

$ |

|

$ |

|

$ |

|

$ |

|

||||

Revolving credit facilities |

|

|

|

|

|

|

|

|

||||

Affiliate line of credit |

|

|

— |

— |

||||||||

Total |

$ |

|

$ |

|

$ |

|

$ |

|

||||

Note 7. Debt

Mortgage Loans Payable

Mortgage loans payable are secured by the properties on which the debt was placed and are considered nonrecourse debt. The Company was in compliance with all of its debt covenants related to its mortgage loans payable as of March 31, 2025 and December 31, 2024. Fixed-rate mortgage loans payable are composed of the following as March 31, 2025 and December 31, 2024:

Weighted average |

Weighted average |

|||||||||

contractual |

maturity |

Principal Balance Outstanding |

||||||||

Indebtedness |

|

interest rate |

|

dates |

|

March 31, 2025 |

|

December 31, 2024 |

||

Mortgages |

% |

1/21/2030 |

$ |

|

$ |

|

||||

Deferred financing costs |

|

|

|

|

|

( |

|

( |

||

Mortgages payable, net |

|

|

|

|

$ |

|

$ |

|

||

Affiliated Lines of Credit

On January 2, 2025, the Operating Partnership entered into an uncommitted revolving loan agreement with NM Partners Manager Holdings, L.P., a Delaware limited partnership and affiliate of the Adviser, providing for a discretionary and uncommitted credit facility in a maximum aggregate principal amount of $

|

|

Total Amount Outstanding |

||||||

Entity |

|

Interest Rate |

|

March 31, 2025 |

|

December 31, 2024 |

||

NEWLEASE Operating Partnership LP |

|

Variable (1) |

$ |

|

$ |

— |

||

(1) |

The interest rate is equal to the Daily Simple SOFR rate (rounded to the nearest 1/100th) + |

On March 26, 2025, NEWLEASE entered into a committed revolving loan agreement with NM Partners Manager Holdings, L.P., a Delaware limited partnership and affiliate of the Adviser, providing for a committed credit facility in a maximum aggregate principal amount of $

18

Revolving Lines of Credit

The Company has a revolving loan with City National Bank. The original loan, dated November 22, 2022, was for $

Total Amount Outstanding |

||||||

Indebtedness |

|

March 31, 2025 |

|

December 31, 2024 |

||

Revolving credit facilities(1) |

$ |

|

$ |

|

||

Deferred financing costs |

( |

— |

||||

Revolving credit facilities, net |

|

$ |

|

$ |

|

|

(1) |

The interest rate is equal to the Daily Simple SOFR rate (rounded to the nearest 1/100th) + |

Scheduled Principal Payments

Scheduled principal payments on mortgage loans payable and revolving credit facilities are as follows:

2025 (Remaining) |

|

$ |

|

2026 |

|

|

|

2027 |

|

|

|

2028 |

|

|

|

2029 |

|

|

|

2030 |

|

||

Thereafter |

|

|

|

Unamortized deferred loan costs |

|

( |

|

$ |

|

Note 8. Leases

Substantially all of the Company’s tenants are subject to master-lease agreements where the tenant is generally responsible for minimum monthly rent and actual property operating expenses incurred, including property taxes, insurance and maintenance. In addition, the Company’s tenants are typically subject to future rent increases based on fixed amounts or, in limited cases, increases in the consumer price index. Certain of the Company’s properties are subject to leases under which it retains responsibility for specific costs and expenses of the property. The Company’s leases typically provide the tenant one or more multi-year renewal options to extend their leases, subject to generally the same terms and conditions, including rent increases, consistent with the initial lease term.

All lease-related income is reported as a single line item, Rental revenue, in the consolidated statements of operations. Rental revenue is comprised of the following:

|

For the three months ended |

|||||

March 31, |

March 31, |

|||||

|

2025 |

|

2024 |

|||

Base rent(1) |

$ |

|

$ |

|

||

Straight-line rent |

|

|

|

|

||

Variable lease payments(2) |

|

|

|

|

||

Amortization of (above) / below market lease value |

|

|

|

|

||

$ |

|

$ |

|

|||

| (1) | Base rent consists of fixed lease payments. |

| (2) | Variable lease payments consist of property tax and insurance reimbursements, property management fees, and rental income with CPI adjustments. |

19

Annual future contractual base rents due to be received under non-cancelable operating leases in effect at March 31, 2025 are as follows:

2025 (Remaining) |

|

$ |

|

2026 |

|

||

2027 |

|

|

|

2028 |

|

|

|

2029 |

|

|

|

2030 |

|

|

|

Thereafter |

|

|

|

$ |

|

Concentration of Credit Risk

As of March 31, 2025, the Company’s portfolio is occupied by

|

Three Months Ended |

|

Three Months Ended |

|||

March 31, |

March 31, |

|||||

2025 |

2024 |

|||||

PCI Pharma Services |

$ |

|

$ |

|

||

Note 9. Income Taxes

The Company has elected to be taxed as a REIT under the applicable provisions of the Code for every year beginning with the year ended December 31, 2018. The Company pays state income tax, related to income apportioned to the state, and income tax to foreign governments related to income derived from assets in foreign countries. For the three months ended March 31, 2025, the Company incurred current income tax expense of $

Note 10. Related and Affiliated Party Transactions

The following table details the components of due to affiliates:

|

March 31, |

|

December 31, |

|||

|

2025 |

|

2024 |

|||

Accrued management fee |

$ |

|

$ |

— |

||

Performance participation allocation |

|

|

|

— |

||

Advanced organization and offering costs |

|

|

|

— |

||

Accrued interest – affiliated line of credit |

|

|

|

— |

||

Fees for services provided by the Adviser |

|

|

|

— |

||

Other advanced expenses |

|

|

|

|

||

Total |

$ |

|

$ |

|

||

20

Accrued management fee

The Company pays the Adviser a management fee equal to (1)

The management fee may be paid in cash, Class E shares, or Class E OP Units, at the Adviser’s sole election. The Adviser has elected to receive management fees in cash and Class E OP units. During the three months ended March 31, 2025 and March 31, 2024, the Company incurred management fees of $

During the three months ended March 31, 2025 and March 31, 2024, the Company has

Performance participation allocation

So long as the Advisory Agreement has not been terminated, NEWLEASE Special Limited Partner LP, (the “Special Limited Partner”) holds a performance participation interest in the Operating Partnership that entitles it to receive in the aggregate an allocation from our Operating Partnership equal to, (1) with respect to Class I units,

Performance participation allocation is measured on a calendar year basis and is paid quarterly in cash, Class E shares, or Class E OP Units, at the Adviser’s sole election. The Adviser has elected to receive performance participation allocation in Class E OP units. During the three months ended March 31, 2025 and March 31, 2024, the Company incurred performance participation allocation of $

As of March 31, 2025, the Company accrued $

Advanced organization and offering costs

The Adviser has agreed to advance organization and offering costs (including legal, accounting and other expenses attributable to the organization), excluding certain investment-related expenses and financing expenses, on behalf of the Company through the first anniversary of the initial closing of the Company’s private offering (the “Anniversary Date”). The Company will reimburse the Adviser for all such advanced expenses ratably over the 60-month period following January 2, 2026. After the Anniversary Date, the Company will reimburse the Adviser for any organization and offering costs associated with the private offering that it incurs on the Company’s behalf when incurred.

Accrued interest – affiliated line of credit

The amount represents the interest accrued as of March 31, 2025 on an interest-bearing line of credit entered into with an affiliate of the Sponsor. Refer to Note 7 – Debt.

21

Fees for services provided by the Adviser

We retain certain affiliates of the Adviser, from time to time, for administrative and sales purposes. The Company reimburses the affiliates for the allocable portion of overhead and other expenses incurred by it in performing its obligations to the Company, which includes the fees and expenses associated with performing administrative, finance, asset management, sales, investor relations, and compliance functions.

Other advanced expenses

The Company leverages the broader infrastructure of the Sponsor including utilizing the Sponsor’s accounts payable team to pay all expenses on behalf of the Company, and the Company subsequently reimburses the Sponsor for these expenses.

Note 11. Equity and Noncontrolling Interests

Formation Transactions

On January 2, 2025, NEWLEASE completed a recapitalization transaction, pursuant to which NM Fund I completed the REIT Contribution, whereby it contributed

For comparability purposes for periods prior to the closing of the Formation Transaction on January 2, 2025, the Predecessor’s shares are adjusted to reflect the retrospective impact of the Formation Transactions for the

Authorized capital

The Company has the authority to issue an unlimited number of common shares, including an unlimited number of shares classified as Class A shares, Class F shares, Class I shares and Class E shares, and an unlimited number of shares classified as preferred shares. Each class of common shares and preferred shares has a par value of $

The share classes have different management fees and performance participation allocation but the same economic and voting rights. See Note 10 for further details.

Common shares

The following table details the change in the Company’s common shares:

|

Class A |

|

Class F |

|

Class I |

|

Class E |

|

Total |

|

December 31, 2024 |

|

|

|

|

|

— |

|

|

|

|

Common shares issued |

|

|

|

|

|

|

|

|

|

|

Distribution reinvestment |

|

— |

|

— |

|

— |

|

— |

|

— |

Common shares repurchased |

|

( |

|

— |

|

— |

|

( |

|

( |

March 31, 2025 |

|

|

|

|

|

|

|

|

|

|

22

Share repurchases

Shareholders may request on a quarterly basis that the Company repurchase all or any portion of their shares pursuant to our share repurchase plan, provided, that, subject to certain limited exceptions, holders of Class A shares and Class F shares (collectively, the “Anchor Shares”) may not submit Anchor Shares for repurchase until the January 1, 2027. We are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular calendar quarter in our discretion. In addition, our ability to fulfill repurchase requests is subject to a number of limitations. As a result, share repurchases may not be available each quarter. Under our share repurchase plan, to the extent we choose to repurchase shares in any particular calendar quarter, we will only repurchase shares following the close of business day as of the last calendar day of that calendar quarter (each such date, a “Repurchase Date”). Repurchases will be made at the transaction price in effect on the Repurchase Date, except that shares that have not been outstanding for at least one year will be repurchased at

The aggregate NAV of total repurchases of shares, shares, shares and Class E shares is limited to no more than

In the event that we determine to repurchase some but not all of the shares submitted for repurchase during any calendar quarter, shares repurchased at the end of the applicable calendar quarter will be repurchased on a pro rata basis. All unsatisfied repurchase requests must be resubmitted after the start of the next calendar quarter, or upon the recommencement of the share repurchase plan, as applicable.

In connection with the completion of the Formation Transactions, the Company repurchased

Distributions

The Company intends to make monthly distributions to shareholders. Each class of common shares receives the same gross and net distribution per share. Shareholders do not pay servicing fees.

The following table details the aggregate distributions declared for each share class for the three months ended March 31, 2025 and March 31, 2024:

Three Months Ended March 31, 2025 |

|||||||||

Gross |

Shareholder |

||||||||

|

Distribution |

|

Servicing Fee |

|

Net Distribution |

||||

Class A Common Shares |

$ |

|

$ |

$ |

|

||||

Class F Common Shares |

$ |

|

$ |

$ |

|

||||

Class I Common Shares |

$ |

|

$ |

$ |

|

||||

Class E Common Shares |

$ |

|

$ |

$ |

|

||||

Three Months Ended March 31, 2024 |

|||||||||

Gross |

Shareholder |

||||||||

|

Distribution |

|

Servicing Fee |

|

Net Distribution |

||||

Class A Common Shares |

$ |

|

$ |

$ |

|

||||

Class F Common Shares |

$ |

|

$ |

$ |

|

||||

Class I Common Shares |

$ |

|

$ |

$ |

|

||||

Class E Common Shares |

$ |

|

$ |

$ |

|

||||

23

The Company has adopted a distribution reinvestment plan, whereby Class I shareholders can elect to have their cash distributions reinvested in Class I shares commencing with any distribution paid on or after July 1, 2025. Any cash distributions attributable to the Class I shares owned by participants in the distribution reinvestment plan will have their cash distributions immediately reinvested in our Class I shares on behalf of the participants on the business day such distribution would have been paid to such shareholder. The per share purchase price for Class I shares purchased pursuant to the distribution reinvestment plan will be equal to the transaction price at the time the distribution is payable. Class I shares acquired under the distribution reinvestment plan will entitle the participant to the same rights and be treated in the same manner as Class I shares purchased in the private offering.

Non-controlling interest

Non-controlling interests represent interests in the Company’s investments held by an affiliate of New Mountain through a joint venture. Allocation of net income or loss is generally based upon relative ownership interests held by equity owners in each investment.

Share-based compensation

On January 2, 2025, each of the

Note 12. Earnings Per Share